Car depreciation calculator tax deduction

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200. Deduct car depreciation.

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

The other two ways are more logarithmic which could help small business owners by allowing for a larger car tax deduction earlier.

.png)

. You can take a special depreciation allowance to recover part of the cost of qualified property defined next placed in service during the tax year. Select the currency from the drop-down list optional Enter the purchase price of the vehicle. With this handy calculator you can calculate the depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

Prime Cost Method for Calculating Car Depreciation. For applicable vehicles the IRS caps depreciation deductions at. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the.

Alternatively if you use the actual cost method you may take deductions for. You use the car for business purposes 75 of the time. The first is the actual expense method which uses straight-line depreciation.

In the Vehicle Expenses section TurboTax allows you to compare the Standard Mileage Deduction with your actual expenses. When its time to file your. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.

The special car depreciation allowance equals 50 of your total depreciation write-off. Cost of Running the Car x Days you owned 365 x. It can be used for the 201314 to 202122 income years.

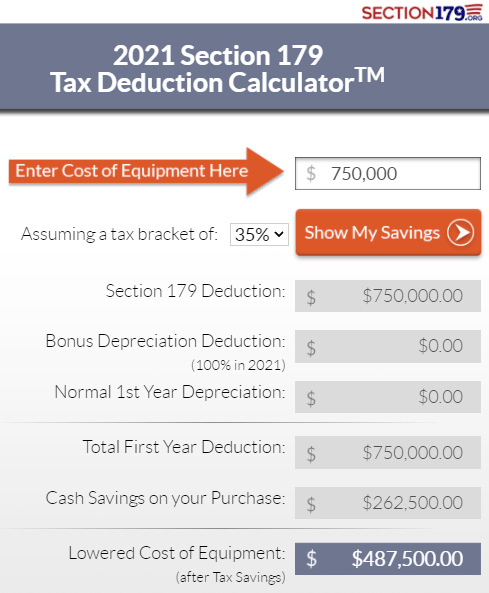

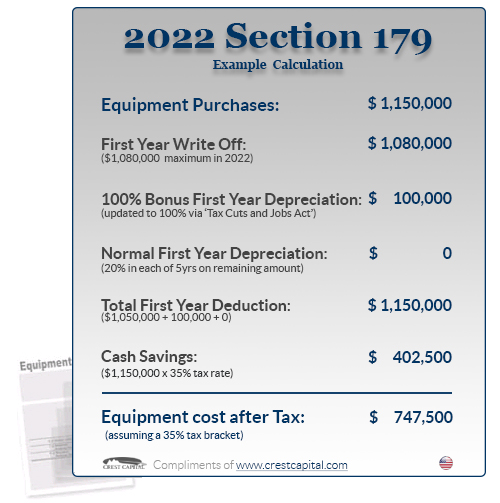

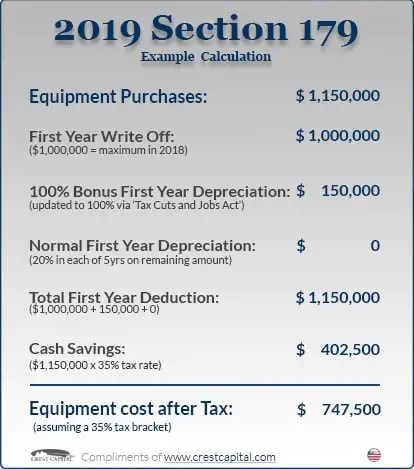

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later. Input the current age of the vehicle - if the car is new simply. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can.

Example Calculation Using the Section 179 Calculator. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. If you were to claim the Section.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. 510 Business Use of Car. So 11400 5 2280 annually.

SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. The Standard Mileage Rate includes a. For example lets say you spent 20000 on a new car for your business in June 2021.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. There are three ways for small business owners to calculate car depreciation deductions. We will even custom tailor the results based upon just a few of.

Current car depreciation rates show that the value of a new car or truck purchased in 2019 can drop by over 20 over the course of the first 12 months you own the vehicle. Depreciation of most cars based on ATO estimates of useful life is. To calculate the depreciation of your car you can use two different types of formulas.

Free Macrs Depreciation Calculator For Excel

1

The Current State Of The Section 179 Tax Deduction

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Macrs Depreciation Calculator With Formula Nerd Counter

Irs Updates Auto Depreciation Limits For 2020

Section 179 Deduction Hondru Ford Of Manheim

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Section 179 Tax Deduction Mullinax Ford Of Olympia

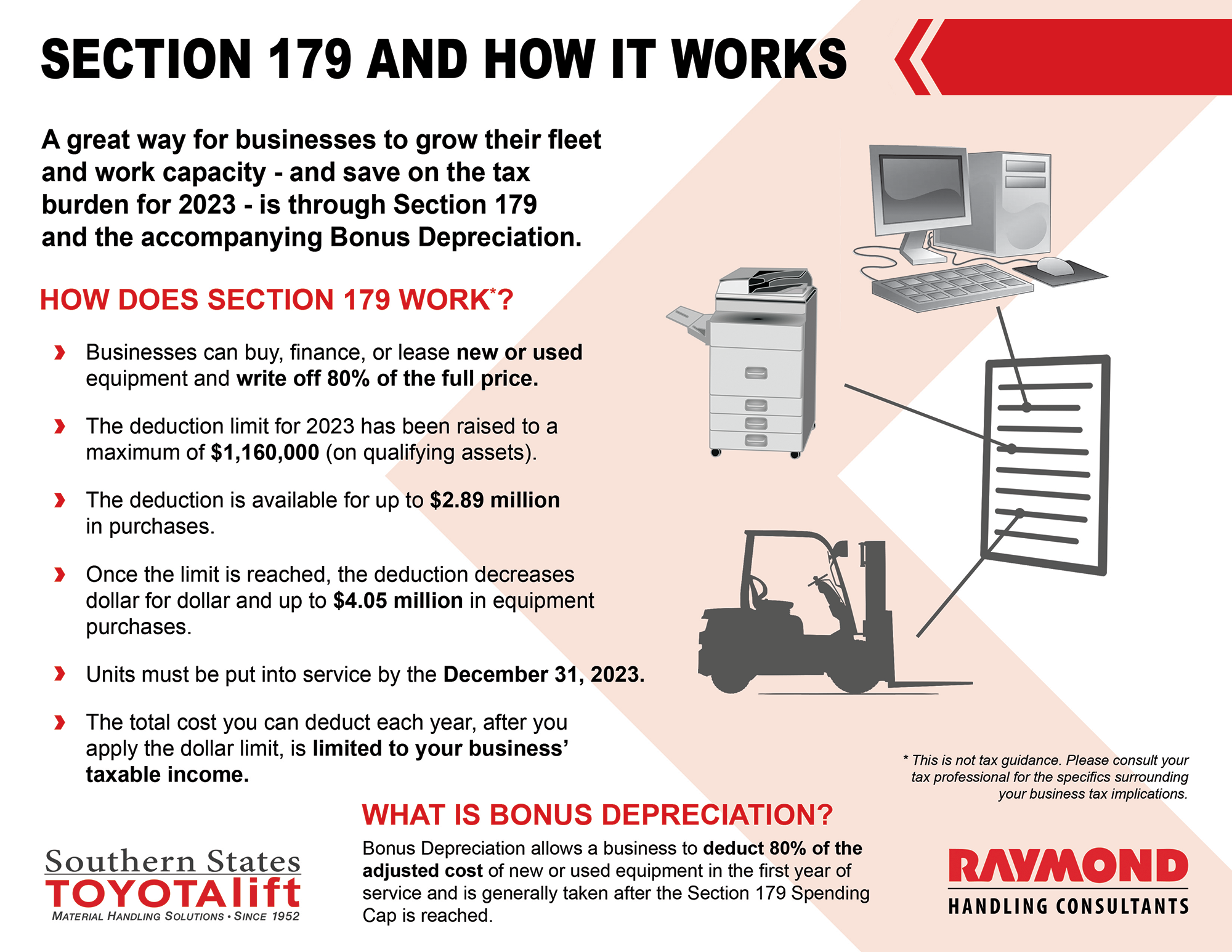

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

1

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

1

Real Estate Lead Tracking Spreadsheet Tax Deductions Free Business Card Templates Music Business Cards